Edward Dowd Biography

Edward Dowd is an entrepreneur, innovator, and Founding Partner of Phinance Technologies, a global macro alternative investment firm. He has a diverse background in the financial industry, with experience in credit markets, equity markets, and portfolio management. Edward is also the author of the book “Cause Unknown: The Epidemic of Sudden Deaths in 2021 & 2022,” which offers a unique perspective on a concerning public health issue.

Edward Dowd Wiki

1. Work Experience

Vice President – HSBC Securities, Inc. (Jan 1990 – Jan 1995)

At HSBC Securities, Inc., Edward distributed fixed income products and research to institutional investors. He rapidly progressed in his career, being promoted to Assistant Vice President in 1993 and then to Vice President in 1994. Edward’s exceptional sales performance led to generating gross sales commission of over $1 million, consistently ranking among the top third of the sales force.

Summer Equity Analyst – Reams Asset Management (May 1996 – Aug 1996)

During his time at Reams Asset Management, Edward conducted research and analysis of value-oriented investment opportunities. He authored research reports, utilized various valuation models, and performed fundamental analysis to evaluate stocks.

Equity Research Associate Electric Utilities – Donaldson, Lufkin & Jenrette (1997 – 1999)

As an Equity Research Associate at Donaldson, Lufkin & Jenrette, Edward developed investment theses using multiple valuation methods and analyzed company and industry fundamentals. He coauthored research notes and reports on electric utilities companies and marketed investment recommendations to institutional investors and the DLJ sales force.

Senior Vice President – Independence Investments LLC (1999 – 2002)

Edward led the technology group at Independence Investments LLC, where he facilitated meetings to generate investment themes and actions within the sector. He derived investment ratings, earnings estimates, and growth rates for enterprise software and telecom equipment stocks. Additionally, he recommended new stocks to Independence Investments’ working list.

Managing Director, Equity Portfolio Manager – BlackRock (Nov 2002 – Oct 2012)

During his tenure at BlackRock, Edward co-managed The BlackRock Capital Appreciation Fund and institutional separate accounts. He successfully managed a $14 billion Growth equity portfolio for ten years. Edward’s expertise and contributions played a significant role in marketing the large cap growth product, resulting in the growth of assets from $2 billion to $14 billion. He collaborated with a co-manager and fund analysts to generate new investment ideas.

Portfolio Manager – FIM Group (Aug 2014 – Apr 2016)

Edward developed an entrepreneurial Global Concentrated Growth Product at FIM Group, targeting institutional investors and high net worth individuals. He focused on absolute returns and implemented a long-term investment strategy. Additionally, he worked closely with the Chief Investment Officer (CIO) to manage the current product suite and assisted in portfolio sector and security allocations.

Managing Partner, CIO Equities – OceanSquare Asset Management, LLC (Mar 2017 – Mar 2019)

As a Managing Partner at OceanSquare Asset Management, Edward played a key role in establishing the firm’s collaborative, concentrated, and disciplined investment approach. He led the equity portfolio as the Chief Investment Officer (CIO) and focused on generating long-term performance for clients.

Founding Partner – Phinance Technologies (Jun 2022 – Present)

Edward is currently a Founding Partner at Phinance Technologies, a global macro alternative investment firm. The firm’s flagship product is a Futures fund that utilizes proprietary fundamental economic algorithms to generate investment ideas. With a focus on rigorous risk overlays and providing a liquid alternative to traditional asset classes, the fund is designed to be a conservatively leveraged investment option.

Don’t Miss: The Biography of Mario Nawfal, A young an innovative entrepreneur.

2.Edward Dowd Education

Edward Dowd obtained a BBA in Finance and Anthropology from the University of Notre Dame. He later pursued an MBA in Finance from Indiana University – Kelley School of Business. During his academic years, Edward actively participated in various investment-related activities and societies.

Edward Dowd Age

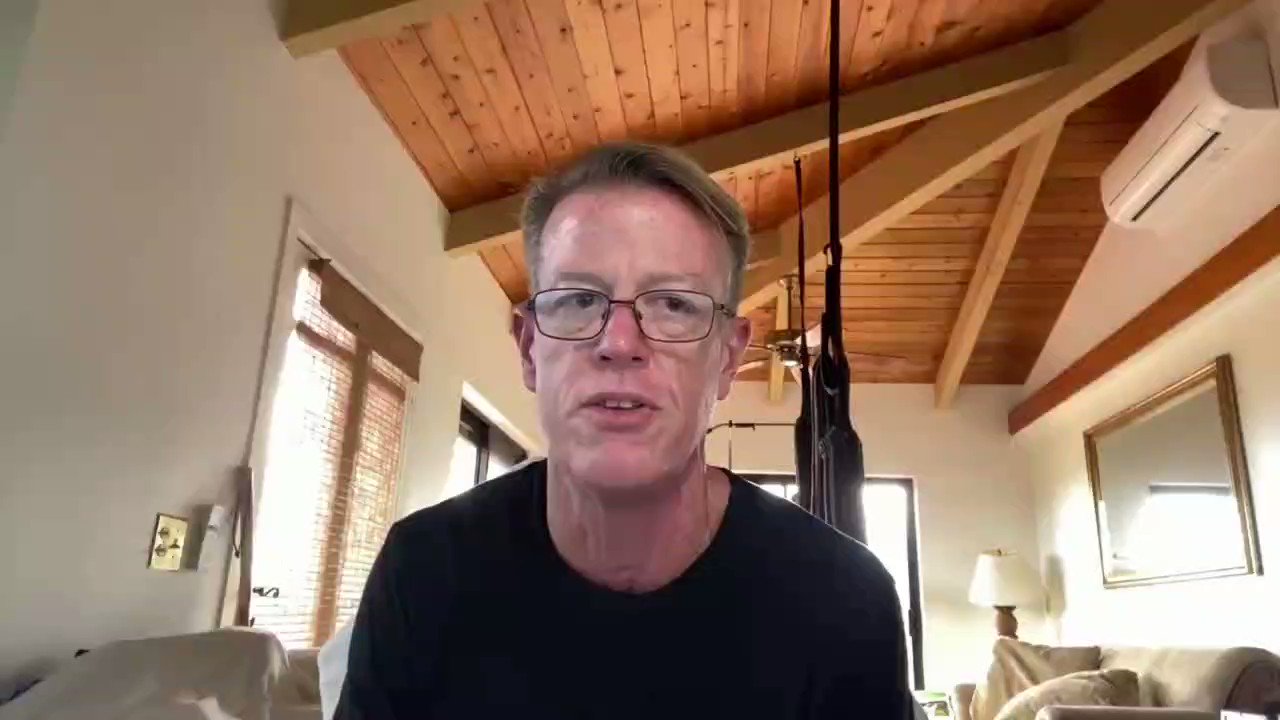

Dowd is currently between 50 to 60 years old as of 2025.

Edward Dowd Height and Attributes

Standing at a height of 5 feet 10 inches tall, Edward has light brown eyes and often wears glasses. He sports short wavy hair that is well-trimmed.

Edward Dowd Wife

Edward Dowd has not revealed whether he is married or not at the moment. This information will be updated as soon as it is available.

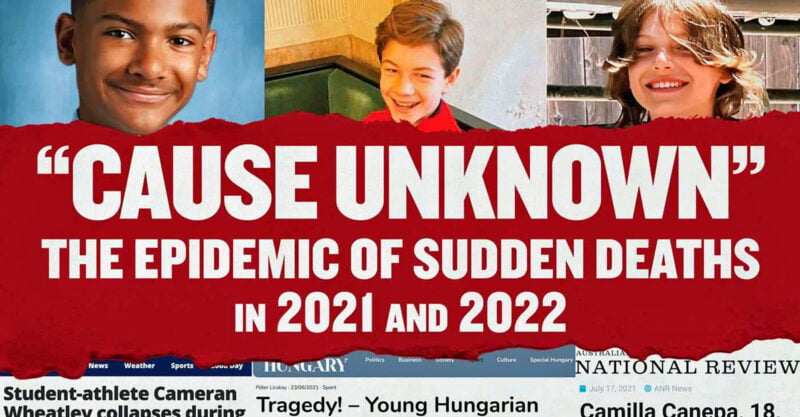

Edward Dowd Book: Cause Unknown

Edward Dowd authored the book “Cause Unknown: The Epidemic of Sudden Deaths in 2021 & 2022.” Released on December 13, 2022, by Skyhorse Publishing, the book sheds light on the human reality behind the statistics of sudden deaths. It examines the concerning rise in unexpected deaths among young athletes and healthy individuals. The book challenges the perception of normalcy and raises awareness about a growing public health concern.

The narrative explores instances of sudden deaths in different settings, including sports, performances, and everyday life, emphasizing the significance of these occurrences. Edward Dowd’s book encourages readers to reflect on their own experiences and intuition to recognize the abnormality of these events in recent years.

Edward Dowd Net Worth

As of 2025, Edward Dowd has achieved substantial financial success, with an estimated net worth of around $15 million. His years of experience in the financial industry, coupled with his entrepreneurial ventures and investment expertise, have contributed to his wealth accumulation.

Edward’s diligent work ethic, strategic decision-making, and ability to navigate the complexities of the market have played a pivotal role in his financial achievements. With his continued involvement in Phinance Technologies and previous high-profile positions, Edward Dowd’s net worth reflects his dedication to the field and his ability to generate significant value in the investment landscape.